Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Highlight & stories

1 June 2021, by ADGM's Staff Editor

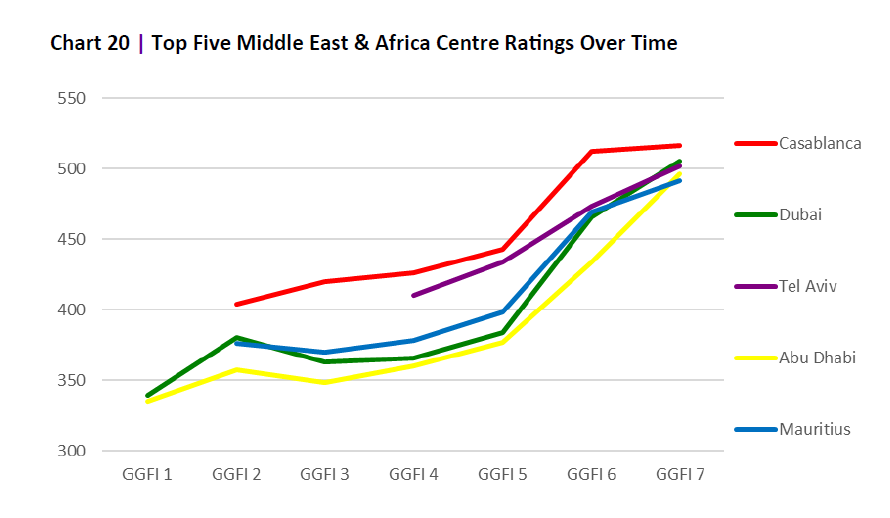

Abu Dhabi has once again been ranked as a leading global green financial centre in the latest Global Green Finance Index report (GGFI 7), being placed 4th highest in the MENA region and 50th globally, boosting its position by 21 ranks compared to last year -- the biggest increase in both metrics globally.

The ranking upholds the robustness of Abu Dhabi’s thriving sustainable finance ecosystem and toolbox. Initiatives led by Abu Dhabi Global Market (ADGM) such as the UAE Guiding Principles, the Abu Dhabi Sustainable Finance Declaration and the Abu Dhabi Sustainable Finance Forum contributed to the rapid maturation of Abu Dhabi’s thriving sustainable finance industry, which reinvented itself to become one of the key hubs globally.

The collaborative efforts among Abu Dhabi’s government, private sectors and ADGM have all played a critical role in taking the economy closer to carbon neutrality.

Since 2019, the Abu Dhabi Sustainable Finance Declaration has placed a clear objective to ‘collaborate to create a framework for fostering and integrating green and sustainable investments in the Emirate of Abu Dhabi, the UAE and the wider region’. While ambitious, the goals beset by the declaration have motivated the broader sustainable finance ecosystem as well as position Abu Dhabi on the global stage as a responsible and forward thinking financial centre. More recently, the diversity and popularity of green financial products in the emirate among investors, act as proof to the growth of the industry.

Also, the 3rd edition of the Abu Dhabi Sustainable Finance Forum (ADSFF) organized by ADGM proposed a clear roadmap to transition towards a net-zero economy that is built on sustainable innovation and business practices. ADSFF plays a major role in creating synergies among all Abu Dhabi financial industry stakeholders, particularly as it aims to go against the grain by asking the tough questions related to clean energy, gender equality, ESG investing, tech-enabled social impact, and so on. Attendees of the latest ADSFF edition have voiced their enthusiasm by saying that the discussions held on stage showcased the importance of sustainable finance in slowing down climate change and to build towards an inclusive economy. The road towards economic and environmental resilience will depend on the sustainable finance industry’s ability to tackle ESG-related issues by embedding them as a central tenet of every touchpoint and decision.

The giant leaps made in the GGFI 7 ranking are great indicators of the development of Abu Dhabi’s sustainable finance ecosystem in just one year. Abu Dhabi’s sustainable finance industry has developed a holistic strategy that is paying dividends on many levels, particularly when the entire global economic chain continues to be impacted by the pandemic.

Abu Dhabi policymakers, financial institutions and business leaders are committed to retaining sustainability at the core of recovery plans and with these requiring substantial public and private finance, sustainable finance is now coming to the fore.

Abu Dhabi: A ‘Deep’ and ‘Dynamic’ Financial Centre

This is the 7th edition of the Global Green Finance Index (GGFI 7) report. The GGFI model looks at 140 instrumental factors to quantitatively assess each financial centre’s ranking, grouped into 4 main categories: Sustainability, Infrastructure, Human Capital, and Business. Also the report depends on anecdotal evidence from a worldwide survey of finance professionals’ assessments on the quality and depth of green finance offerings in financial centres.

The GGFI is published by Z/Yen Partners and has become an industry reference into the development of green finance for policy and investment decision makers.

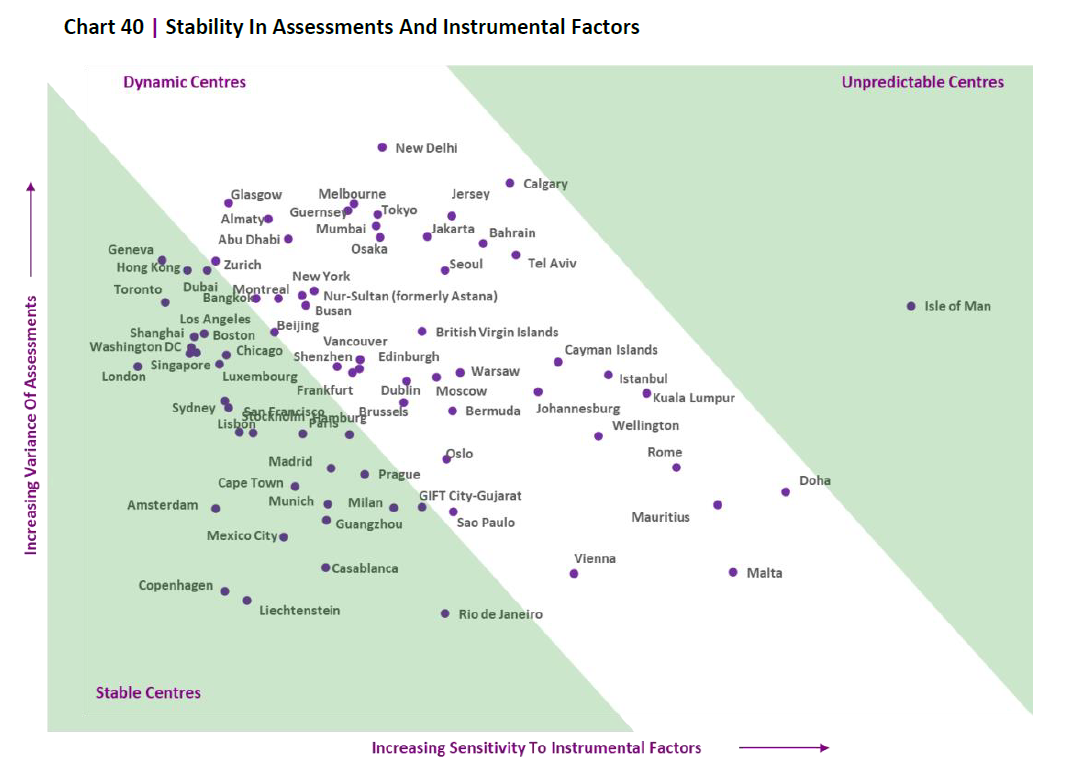

According to the report, Abu Dhabi is classified as an International Financial centre that is ‘relatively deep’ and powered by international specialists with a diverse skill set. Since the first edition of the report which was published in 2018, Abu Dhabi has increased its rating by 156 points and is showing no signs of slowing down. The sharpest increase in the rating could be seen between GGFI 5 and 7, however, what’s more interesting is the fact that Abu Dhabi’s financial centre sustained its growth momentum compared to other regional centres amid the pandemic. This growth momentum underscores Abu Dhabi sustainable finance ecosystem’s ability to innovate and avert the impact of economic slowdown through digitalisation and business support measures. Also, the increased awareness of the stakeholders involved, combined with the business support measures have conjointly accelerated the development of socially conscious business operations, especially in light of the pandemic.

Also, Abu Dhabi has been identified as a ‘Dynamic’ financial centre, which manages to balance between financial risk exposure and seizing opportunities created by investing in human capital, infrastructure, and progressive regulations.

Financial centres play a critical role in driving forward sustainable finance, in fact, the latter has a direct impact on society, environment, and even policy making.

International Financial Centres: A dynamic nexus between Abu Dhabi and the global sustainable finance industry

Sustainable finance can be broadly understood as financing and related institutional and market arrangements that contribute to the achievement of strong, sustainable, balanced and inclusive growth, through supporting directly and indirectly the framework of the UN's 17 Sustainable Development Goals (SDGs).

As included in the European Commission’s Action Plan 'sustainable finance' refers to the process of taking due account of environmental and social considerations when making investment decisions, leading to increased investment in longer-term and sustainable activities. More specifically, environmental considerations refer to climate change mitigation and adaptation, as well as the environment more broadly and the related risks (e.g. natural disasters). Social considerations may refer to issues of inequality, inclusiveness, labour relations, investment in human capital and communities.The governance of public and private institutions, including management structures, employee relations and executive remuneration, plays a fundamental role in ensuring the inclusion of social and environmental considerations in the decision-making process.

All three components – environmental, social and governance (ESG) – are integral parts of sustainable economic development and finance.

Sustainable finance focuses on driving players throughout the financial system to integrate ESG objectives into their activities and capital allocation. For an entity, it involves a focus on improving its own performance across ESG factors. From an investor standpoint, it includes a number of investing approaches, such as screening assets based on environmental, social criteria, the integration of ESG factors in investment decision-making, and investment based on social impact, among others. It also involves the bond market, with the issuance of green, social, and sustainability bonds, where proceeds are restricted for assets with environmental or social purposes, or a combination of the two.

It is undeniable that the global financial market is increasingly focused on the sustainability imperative. This is being translated into action on many fronts – for example, institutional investors are rapidly signing up to the UN Principles for Responsible Investment; large asset owners are significantly scaling up green finance commitments; and regulatory and disclosure frameworks are being developed and mandated, particularly on ESG and climate risk.

Financial centres taking a proactive and leading position on sustainable finance are now putting in place long-planned efforts to create a market around financial products and services dedicated to funding sustainable projects, assets and companies.

Since inception, actions to establish ADGM as a Sustainable Finance Hub have focused on the following:

- Integrating sustainability into ADGM regulatory framework: ADGM, in collaboration with the 10 UAE Regulators and Exchanges, published the UAE’s first set of Guiding Principles on Sustainable Finance, serving as a catalyst in the implementation of the UAE’s sustainability priorities.

- Promoting ongoing cooperation: through the Abu Dhabi Sustainable Finance Declaration and international partnerships (FC4S, IOSCO, NGFS).

- Fostering communication knowledge and awareness: though the launch of the Abu Dhabi Sustainable Finance Forum, part of Abu Dhabi Sustainability Week and in association with the London Institute of Banking & Finance, including the launch of the Certificate in Sustainable Finance.

- Reiterating ADGM’s commitment to sustainability as an International Financial Centre (IFC): adopted a series of internal sustainable principles to enhance ADGM’s existing ESG practices.

- Enhancing gender equality in the workplace with the launch of the Gender Equality Initiative (GEI): The GEI has three areas of focus - Leading by Example, Working Collaboratively, and Championing Effective Change. Each of these areas will enable the progression of women into senior roles, committing to identifying and sharing potential impediments and best practices.

ADGM and the UAE Ministry of Climate Change and Environment have also published the 'State of Sustainable Finance Report' which provides an overview of the efforts being made to achieve the SDGs and create a thriving sustainable finance industry.

As the world responds to the COVID-19 pandemic and seeks to restore global prosperity, we must focus on addressing underlying and systemic factors through a sustainability lens. This includes integrating environmental and social considerations into our decision-making, reflecting a deeper understanding of the risks and how we manage them, as well as recognising the opportunities to create value for all stakeholders. ADGM will continue to work with private, public, national and international stakeholders to facilitate the ongoing implementation of sustainable finance best practices and enable the financial industry to play its full role in driving a resilient yet sustainable, economic recovery.

With that said, ADGM is pleased to organize a webcast series in partnership with the UAE Embassy of Luxembourg, Luxembourg Stock Exchange and Abu Dhabi Securities Exchange (ADX). The first session took place on June 1st, and showcased a panel of high-level professionals sharing the different initiatives and achievements of Abu Dhabi and Luxembourg’s financial centres in scaling up sustainable investments, who discussed the following topics:

The role of financial centres to scale up green finance

Insights from Abu Dhabi and Luxembourg’s sustainable finance ecosystems

- How to stay ahead of the curve in the field of climate finance

- ESG investing: Creating a better world?

- Factors to make the global finance industry greener and more sustainable

- Future challenges facing sustainable finance and how to prepare for them

Speakers:

Elisabeth Cardoso Jordao, Ambassador of the Grand Duchy of Luxembourg to the UAE

Julie Becker, CEO, Luxembourg Stock Exchange

Jenny De Nijs, Special Advisor, Luxembourg Ministry of Finance

Emmanuel Givanakis, CEO - Financial Services Regulatory Authority - Abu Dhabi Global Market (ADGM)

Abdulla Al Nuaimi, COO Abu Dhabi Securities Exchange (ADX)