Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Risk Based Approach

The ADGM Financial Services Regulatory Authority adopts a risk-based approach, focusing on areas that present the greatest risk to its regulatory objectives.

Countries should identify, assess, and understand the money laundering and terrorist financing risks for the country, and take action, including designating an authority or mechanism to coordinate actions to assess risks, and apply resources, aimed at ensuring the risks are mitigated effectively. Based on that assessment, countries should apply a risk-based approach (RBA) to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified. This approach should be an essential foundation for the efficient allocation of resources across the anti-money laundering and countering the financing of terrorism (AML/CFT) regime and the implementation of risk-based measures throughout the FATF Recommendations. Where countries identify higher risks, they should ensure that their AML/CFT regime adequately addresses such risks. Where countries identify lower risks, they may decide to allow simplified measures for some of the FATF recommendations under certain conditions.

Countries should require that financial institutions and designated non-financial businesses and professions (DNFBPs) identify, assess and take effective action to mitigate their money laundering and terrorist financing risks.

The ADGM Financial Services Regulatory Authority (FSRA) is a risk-based regulator. This means that the FSRA’s approach focuses on those areas that present the greatest risk to its regulatory objectives.

The Risk-Based Approach (RBA) is an effective way to combat money laundering and terrorist financing. By adopting this approach, competent authorities, financial institutions and DNFBPs are able to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified, and would enable them to make decisions on how to allocate their own resources in the most effective way.

In implementing RBA, financial institutions and DNFBPs should have in place processes to identify, assess, monitor, manage and mitigate money laundering and terrorist financing risks. The general principle of RBA is that, where there are higher risks, financial institutions and DNFBPs should consider and take enhanced measures to manage and mitigate those risks; and that, correspondingly, where the risks are lower, simplified measures may be permitted. Simplified measures should not be permitted whenever there is a suspicion of money laundering or terrorist financing.

Examples of Risk-Based Approach

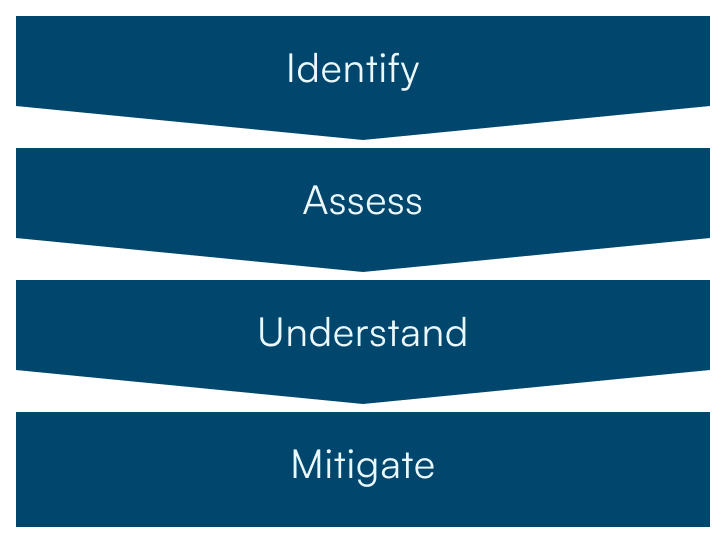

The FATF Recommendation (1) can be considered the groundwork towards the implementation of the risk-based approach:

- Identify: Identify the risk factors

- Assess: Assess the level of risk

- Understand: Understand the impact of risk

- Mitigation: Mitigation plan

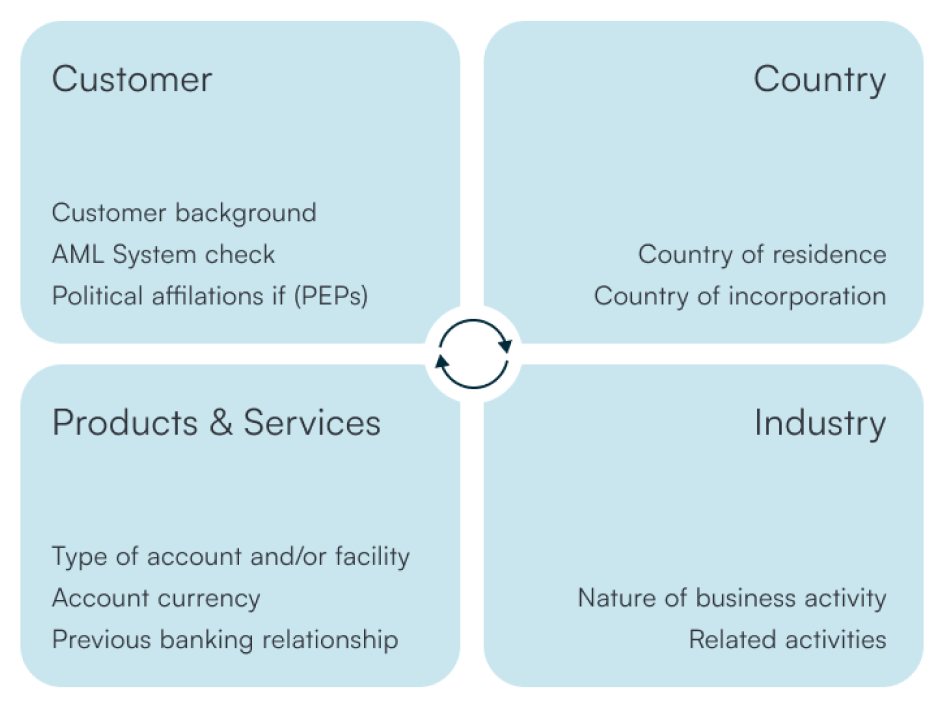

The Wolfsberg risk-based approach guidance has provided an insight on the approach by identifying these components that can assist in measuring the risk. Industry risk related to Business activities in which the customer is involved. "Money laundering risks may be measured using various categories, which may be modified by risk variables. The most commonly used risk criteria are: country risk customer risk and services risk." Based on Wolfsberg's guidance on a risk-based approach, risk factor identification or indicators that can allow the assessment and measurement of the level of risk can be summarized in the following diagram:

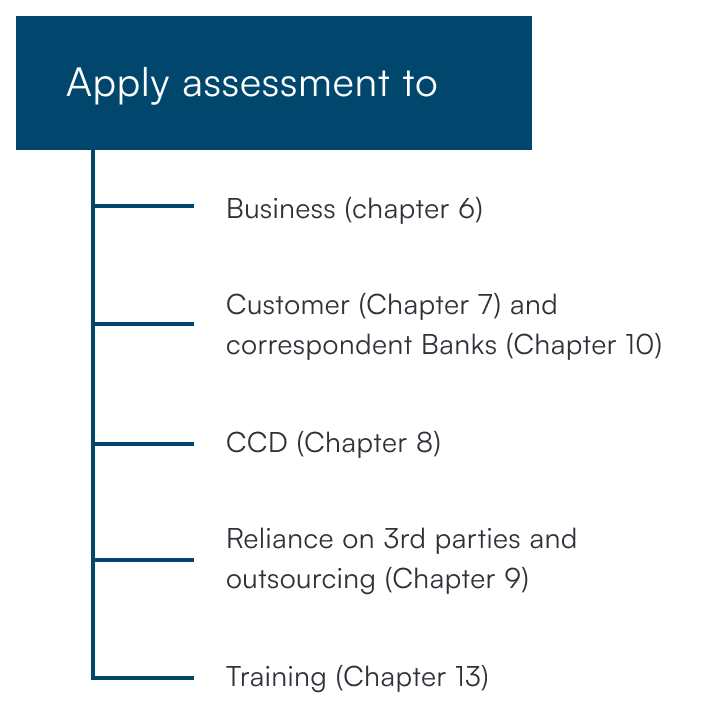

The risk based approach or assessment process should be comprehensive, transparent and well documented. When completing the risk based approach effectively, the end result should create reliable conclusions necessary to establish appropriate policies, procedures, processes and systems required to develop the organisation's Compliance Program.

5.1.1 A Relevant Person must:

- Assess and address its AML risks under the AML Rulebook by adopting an approach which is proportionate to the risks to which the Person is exposed as a result of the nature of its business, Customers, products, services and any other matters which are relevant in the context of money laundering; and

- Ensure that, when undertaking any risk-based assessment for the purposes of complying with a requirement of the AML Rulebook, such assessment is:

- objective and proportionate to the risks

- based on reasonable grounds

- properly documented; and

- reviewed and updated at appropriate intervals.

We offer various support options.