Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

News

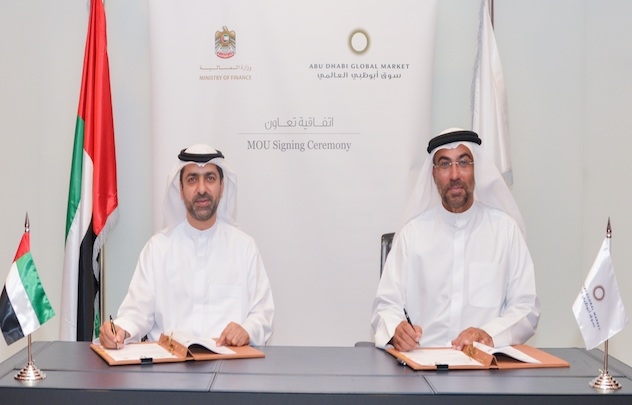

Ministry of Finance and Abu Dhabi Global Market Sign MOU on the Automatic Exchange of Information for Tax Purposes

ADGM FSRA: 12 Jul 2016

Abu Dhabi, July 12, 2016: The Ministry of Finance (MoF) and Abu Dhabi Global Market (ADGM) signed a Memorandum of Understanding (MoU) to establish a framework for Automatic Exchange of Information (AEoI ) on tax purpose and part of their commitment to uphold the Tax information Exchange and International Double Taxation agreements.

The MoU was signed at the office of ADGM on 11 July 2016 by His Excellency Younis Haji Al Khouri, Undersecretary of the Ministry of Finance, and His Excellency Ahmed Al Sayegh, Chairman of ADGM, and in the presence of His Excellency Khalid Ali Al Bustani, Assistant Undersecretary for International Financial Relations, Ministry of Finance.

This agreement will underline the remit and obligations of the two parties to implement international standards and requirements of the automatic exchange of information, and establish appropriate close cooperation to implement relevant international tax agreements, as well as develop and maintain up to date guidelines in compliance with international tax treaties.

The agreement will stress the need for all financial institutions operating under ADGM licence to provide their data on annual basis through the agreed upon automated system. The agreement will also allow implementation of Foreign Account Tax Compliance Act (FATCA) reports and any other up to date automatic exchange of information agreements. The agreement also specifies maintaining quality and pertinence of the information exchange, communication with competent authority and financial institutions, confidentiality and security of AEoI, and carrying security checks on people and contracts.

Commenting on the MoU, His Excellency Younis Haji Al Khoori said: "The Ministry of Finance continuously seeks to sign similar agreements to ensure implementation of international standards of transparency through providing ADGM with information for tax purposes, and which the Ministry also exchanges with different countries to maintain the global financial and trading standard of the country."

He added: "Signing the agreement contributes to maintaining confidentiality of tax information circulated among stakeholders, as well as in setting plans to face potential data leakage risks."

His Excellency Ahmed Al Sayegh, Chairman, ADGM said : "This MoU with the Ministry of Finance underscores our strong commitment to work together in exchanging pertinent tax-related information that will safeguard and uphold international practice and standards in Abu Dhabi and the UAE. By drawing upon our respective strengths and expertise, we will ensure that appropriate measures are in place to prevent tax evasion, to improve the efficiency of tax collection and ultimately to raise the bar on compliance standards.

He added: "My sincere gratitude to the Ministry of Finance for their unwavering support. We will continue to collaborate closely with them and to cultivate meaningful collaborations and partnerships with all relevant authorities and stakeholders both locally and globally to further cement ADGM's position as a leading international financial centre."

MoF continuously seeks to highlight the importance of exchanging information for tax purposes and its impact on the country’s economy and tax payers. The Ministry had also organised local, regional and international workshops on the exchange of information for tax purposes, which addressed the topics of identifying the common international standards in tax reports, tax reporting implementation mechanisms, and AEoI's legal framework and principles of development.