Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Setting Up

Who can apply for a licence at ADGM?

ADGM is now receiving applications from organisations that wish to undertake Financial and Non-financial Business Activities.

Companies who wish to be registered as a financial service provider will need to first contact the FSRA to start the application process. The team can be contacted at authorisation@adgm.com where companies can arrange for a meeting and will receive guidance through the application process. Once they have gained approval from the FSRA, and then can apply to register the company with the Registration Authority.

Companies who wish to undertake Non-Financial (professional services etc.) and Retail business activities can contact the Business Development team of the Registration Authority.

What are the permitted business activities?

For a detailed description of the permitted Non-Financial and Retail activities within ADGM, please click here: Permitted Business.

For permitted Financial Services activities, please refer to the FSRA rulebook.

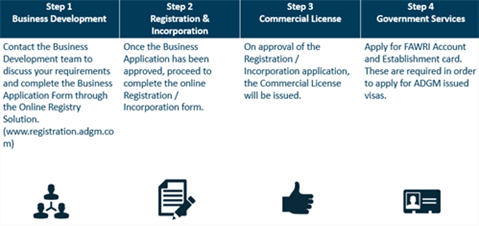

What are the steps involved in the registration and incorporation process?

ADGM has a transparent and business-friendly 4-step registration process.

For more information on the Online Registry Solution, please view our Video Tutorials.

For more information on the application process for the FSRA, please view the 3-step application guide book.

How do I submit an application?

The three ways to submit an application to register a company are as follows:

1. ONLINE APPLICATION - Online is the preferred registration method of ADGM. To view ADGM’S Online Registry Solution, please click here.

2. PAPER-BASED APPLICATION - Paper based applications are available for an additional processing fee. Should you wish to submit a paper form instead of an online form, please contact the Registration Authority to request them. Please note that filing of forms and supporting documents is accepted by the office of the Registration Authority in good faith without any need for the Registrar to inquire into the veracity and accuracy of every filing received by this office. For further information, please refer to ADGM Companies Regulations (Paper Form) Rules 2015.

3. USING A SERVICE PROVIDER - Applicants will be able to complete the registration process by using third party service providers. Service providers will be tasked with representing their clients and will be able to complete registration via the same channels mentioned above.

How much is it going to cost?

The Registration Authority operates a clear and transparent pricing system with no hidden costs. ADGM applies a business activity based methodology for registration and incorporation cost and charges a fee for initial registration and annual fee for renewal.

The fees comprise of several components including a one off fee for name reservation (compulsory) and application for registration of legal entity and a recurring variable fee for application for commercial license which is determined by number of business activities and business activities type.

For the list of fees, please view

How do I reserve a name?

An application to reserve a company name must be submitted to the Registrar along with relevant requirements and fee. Reserved name must be used to incorporate a new company within 30 days from the date of reservation. Reservation can be extended for a further period of 30 days upon submission of name reservation extension form and fee, however reservation can only be extended twice after the initial reservation. Further extension of name reservation will require Registrar’s consent.

In the future, after the legal entity is established, if you wish to change the name of your company, you may also apply to reserve the new company name.

Choosing a company name

KEY STEPS AND APPROACH:

Check availability of the proposed name

Begin by checking that your company name can be reserved. For example, the name you choose cannot be identical or almost identical or too similar to another company name that is already reserved or registered in ADGM. It cannot be offensive or contain certain words that are restricted or protected by other name rules.

To ensure your chosen name is not the ‘same as’ or identical to an existing name of any company, conduct a search in ADGM Companies Register. You should also check existing trademarks by contacting the Ministry of Economy and/or similar office in other jurisdictions to ensure that the proposed name does not infringe an existing trade.

For more information on words that are offensive or restrictive, please refer to Business and Company Name Rules 2015 (coming 15 June).

Apply for your name reservation online

Whether you are applying for a name to incorporate a company or to change a name for an existing company, the process is the same. Visit ADGM's Online Registry Solution to register and fill out the "Name Reservation" form.

The fee associated with name reservation is US$200. Name reservation is valid for the period of 30 calendar days. It can be renewed for the period of another 30 days by submitting renewal of name reservation form along with the fee of US $200.

How we process your application

You will receive an email confirming that your application is under process and an email confirming once approval or rejection.

What happens next?

You must use the name to incorporate a new company or change the name of an existing company within 30 calendar days. Should the process of gathering information for application for incorporation or registration take longer, you may renew the name reservation by applying for renewal and paying renewal fee. This will give you another 30 calendar days to prepare your application for incorporation or registration.

What forms will I be required to fill out?

The Online Registry Solution offers our clients an innovative, user friendly way to register and incorporate your orgainsation. Currently the following forms are available to be completed on the system:

Business Applications for Company & Partnership

Name Reservation

Registration & Incorporation forms for a variety of company and partnership types.

Paper based forms are also available however the fee for submission of these forms is slightly higher than if submitting online.

Supplementary forms may need to be manually submitted to the Registrar. You will be informed by a member of the Registration Authority team if this is necessary, additional fees will not be charged for the submission of paper forms in the event that they are not available online.

For more information on the forms that are applicable for your application, please visit the Business Development and Registration & Incorporation pages of the site.

Please note that filing of forms and supporting documents is accepted by the office of the Registration Authority in good faith without any need for the Registrar to inquire into the veracity and accuracy of every filing received by this office.

How can I make a payment?

Payment to the Registration Authority can be made through the following channels:

Credit Card

Credit card payments can be completed online if you have completed your applications through the Online Registry Solution, or by visiting the office of the Registration Authority below:

USD Account:

Bank Name: First Abu Dhabi Bank (FAB)

Account Name: ADGM REGISTRATION AUTHORITY

Account Number: 4021003571090031

IBAN Number: AE350354021003571090031

Branch: H.O. Sheikh Khalifa Street, Abu Dhabi, UAE

Swift Code/BIC: NBADAEAA

AED Account:

Bank Name: First Abu Dhabi Bank (FAB)

Account Name: ADGM REGISTRATION AUTHORITY

Account Number: 4021003571090020

IBAN Number: AE410354021003571090020

How long is it going to take?

What happens after my entity is registered?

Once the company is registered, the company may commence its business and its directors are bound to adhere with the requirements prescribed by the ADGM Companies Regulations 2015, ADGM Commercial Licensing Regulations 2015 and any other relevant regulations and enabling rules. The directors are required to file certain documents (including but not limited to) annual accounts and an annual return. They must also inform the Registrar about any changes, such as the appointment or resignation of directors or a change to the company’s registered office, etc. For more information, please refer to Guidance Notes – Annual Filing Requirements and Guidance Notes – Event Driven Filings.

If I am licensed at ADGM, can I conduct business activities in Abu Dhabi?

Entities who wish to continue to conduct business outside of Al Maryah Island will need to maintain, or if new then apply for, an Abu Dhabi Department of Economic Development (DED) Licence.

It is the firms responsibility to maintain any required registration, authorisation, licence, approval, consent, permission or similar status in any jurisdiction outside of Al Maryah Island.

Our Business Development team will guide you through the process and answer any questions you may have.

How will firms be regulated within ADGM?

ADGM will have its own judicial system and legislative infrastructure, under three independent authorities:

Financial Services Regulatory Authority

The ADGM Financial Services Regulatory Authority will supervise regulated companies and monitor their compliance with applicable laws, rules and regulations. The ADGM Registration Authority will monitor compliance of the firms with periodic and event-driven filing requirements subject to ADGM Rules and Regulations.

How do I obtain visas and what is their validity?

ADGM will offer a 2 year employee visa and has developed a competitive pricing structure. When determining the employee visa quota for firms, ADGM will take into consideration the business activity, office space and health and safety requirements. Accordingly, each case will be assessed individually.

All visa and government services are proccesed through ACCESSADGM client portal.

For more information on ACCESSADGM and how to register as a user, click here.

How do I obtain an International Securities Identification Number (ISIN) for securities and / or units of a collective investment fund issued from ADGM?

ISINs for Securities (including Units in a Collective Investment Fund) issued from ADGM must be obtained from WM Data Services (WMDS). WMDS can be contacted via its website: https://www.wmdaten.de/

Note 1: The UAE Securities and Commodities Authority does not issue ISINs for ADGM entities.

Note 2: Before applying to WM Data Services for an ISIN an issuer should first obtain a Legal Entity Identifier (LEI) from the ADGM Registration Authority. https://www.adgm.com/operating-in-adgm/post-registration-services/legal-entity-identifier

Note 3: ADGM does not recommend for issuers to use the services of commercial entities who may offer assistance in obtaining and managing ISINs. ISINs can be obtained directly from WMDS, which is a Member of the Association of National Numbering Agencies. More information can be found here: https://www.anna-web.org/

Why do we have a Foundations Regime?

There has also been a strong demand from Private Banks who want to be able to provide locally a full suite of structuring solutions to local and regional clients.

Foundations, like trusts, are used for a variety of purposes including wealth management, planning and preservation. Unlike trusts, however, Foundations are incorporated as a legal entity with their own distinct attributes and legal personality. In this respect, foundations are similar to companies but without shareholders, making them suitable for wealth management across generations.

ADGM foundations support local and international families and High Net Worth Individuals to efficiently manage their business and investment interests across multiple generations.

ADGM foundations supplement ADGM’s existing suite of products and services available to families. To date, the ADGM platform has been widely used by local families for structuring a wide range of business interests using holding companies and Special Purpose Vehicles as well as setting up family offices.

What are the benefits of an ADGM foundation?

ADGM foundations offer a robust balance of client confidentiality and high standards of transparency under the ADGM’s internationally recognised legislative environment. International clients who seek to effectively manage and supervise their wealth and assets under a competitive and international jurisdiction will find ADGM foundations useful. ADGM foundations also serve as an alternative to trusts for financial planning and structuring.

Benefits of ADGM’s Foundations Regime:

Are foundations the same as trusts?

A key feature of a foundation (as compared to a common law trust) is the ability of the founder to retain more control over the foundation.

In contrast, the settlor has a more limited role and, once assets are settled on trust, the duties of trustees are towards the beneficiaries, rather than the settlor.

What are the key features of ADGM’s Foundations Regime?

Does the ADGM Foundations Regime require local representation at ADGM?

An ADGM foundation can decide whether or not it wishes to appoint a registered agent.

Can foreign persons take advantage of ADGM foundations?

Which court has jurisdiction over ADGM foundations?

The ADGM Foundations Regulations preserve a pro-active role for ADGM Courts.

Does the ADGM Foundations Regime provide for the preservation of assets?

Of course, ADGM encourages founders to obtain independent legal and taxation advice on their proposed structures to ensure that they meet their intended objectives.

How long does it take to set up an ADGM foundation?

The ADGM team will provide the appropriate guidance to assist the entities.

How confidential is my information in respect of an ADGM foundation?

What is the cost of an ADGM foundation?

The ADGM Foundations Regime is benchmarked with international best practices and its fees structure is very competitive.

The application fee is $1000, with an annual renewal fee of $200.

What is resolution for incorporation?

Resolution for incorporation is a document signed by all shareholders approving the following:

- Incorporation of the company in ADGM

- Appointment of individual authorized to file the application for incorporation to ADGM

- Appointment of authorized signatories

- Appointment of directors

- Appointment of company secretary (note that this is only mandatory for Public Company Limited by Shares).

- Adoption of Articles of Association.

Do I need a resolution for incorporation?

I am registering a branch, do I need a resolution?

Yes. You need a resolution signed by the board of directors of the foreign company applying to establish a branch in ADGM.

How to submit resolution for incorporation?

- Download the resolution template.

If you are a Private Company Limited by shares and:

- Your shareholder is one person/individual, please download the Sole Shareholder Resolution template.

- Your shareholder is more than one person/individual, please download the Multiple/Individual Shareholder Resolution template.

- Your shareholder is corporate, please download the Corporate Shareholder Resolution template.

If you are a Private Company Guarantee:

- Your shareholder is more than one person/individual founding members, please download the Multiple/Individual Founding Members Resolutions template.

If your are a branch:

- To register your branch, please download the Branch Registration Resolution template.

- Complete the template by providing the details of the highlighted texts.

- Sign the resolution.

- Scan and attach a copy to the application for incorporation as evidence of appointment of authorized signatory, director and attach this document in the shareholder section of the form as resolution approving the incorporation.

Where can I find the resolution for incorporation’s template?

If you are a Private Company Limited by shares and:

- Your shareholder is one person/individual, please download the Sole Shareholder Resolution template.

- Your shareholder is more than one person/individual, please download the Multiple/Individual Shareholder Resolution template.

- Your shareholder is corporate, please download the Corporate Shareholder Resolution template.

If you are a Private Company Guarantee:

- Your shareholder is more than one person/individual founding members, please download the Multiple/Individual Founding Members Resolutions template.

If your are a branch:

- To register your branch, please download the Branch Registration Resolution template.

Can I amend or make changes to the template?

Yes you can, provided the following points are stated on your format.

- Incorporation of the company in ADGM

- Appointment of individual authorized to file the application for incorporation to ADGM

- Appointment of authorized signatories

- Appointment of directors

- Appointment of company secretary. (Please note that this is only mandatory for Public Company Limited by Shares)

- Adoption of Articles of Association.

Can I use Arabic resolution?

Who should sign the resolution?

If you are a Private Company Limited by Shares and:

- Has one person/individual shareholder, the sole shareholder must sign the resolution.

- Has more than one person/individual, all shareholders must sign the resolution.

- Has a shareholder who is a corporate, all directors (or required quorum, whichever is applicable) of the corporate shareholder must sign the resolution.

If you are a Private Company Limited by Guarantee:

- All founding members must sign the resolution.

If you are a Branch:

- All directors (or required quorum, whichever is applicable) of the foreign company must sign the resolution.

Does the resolution requires notarization?

Does the shareholders need to sign the articles in ADGM’s office?

We would like ADGM to witness the signatures of the shareholders, can the shareholders sign the resolutions in ADGM’s office?

What is the Tech Startup Licence?

The ADGM Tech Startup Licence is an operational commercial licence with an incentivised (discounted) licence fee structure to enable startups, that meet the criteria, to set up and scale their business for up to 5 years of initial operations in ADGM.

Can anyone apply for this Licence?

Yes, the ADGM Tech Startup Licence is sector agnostic and is open for entrepreneurs of all nationalities if they meet the application criteria. The licence requires the appointment of a signatory who resides in the UAE.

Any application for the incentivized Tech Start up licence, must pass an initial eligibility review. All applications that will be considered, must be accompanied by a Hub71 approval letter. To apply for this letter, please visit the ADGM/Hub71 Tech Licence Eligibility Form.

What type of business can use the incentivised Tech Startup Licence?

- A technology-driven startup with an innovative business concept that:

- meets the ADGM startup criteria (seed and emergent stages)

- has the potential to scale

- promotes innovation, in terms of the business application and deployment

- has current traction or is at least at the prototype stage

- can be deployed in the UAE and contribute to the development of the local economy

- has a business plan with clearly defined milestones, against which progress can be monitored

- falls within the ADGM regulation remit and business structures

- ADGM tech startup licence does not cover consumer retail, manufacturing or other activities outside of ADGM’s jurisdiction (Al Maryah Island), unless the startup meets the Abu Dhabi Department of Economic Development’s (DED) dual licensing requirements

If my startup meets the emergent stage criteria, would I apply as emergent?

Yes, if the maturity stage of your startup meets the emergent stage criteria at the time of application. If your application is accepted, a USD 4,000 annual licence fee is applicable and the startup has up-to 3 years before transitioning to full licence fee.

Do I need physical office space?

Yes, physical office space on Al Maryah Island is required. Startups must have at least one dedicated desk or office space i.e. hot-desk is not accepted. The startup needs to provide evidence of confirmed office space by presenting an executed Lease Agreement or Membership Agreement.

For details of the office spaces and co-working spaces on Al Maryah island and Al Reem island please click here: ADGM Office Spaces.

Can I apply for employee visas with the Tech Startup Licence?

The ADGM Tech Startup Licence allows you to apply for employee visas based on 3 visa for every 1 dedicated desk space. ADGM issued visas are for up to 3 years. See full visa fee schedule.

All visa related enquiries must be addresses to accessadgm.cases@adgm.com

Do the shareholders have to be physically present to apply for the licence?

Are there any naming conventions for Tech Startup companies?

ADGM tech startups are required to take the legal form of a Private Company Limited by Shares. As per the ADGM Companies Regulations 2015, the names of limited companies must end with either: “limited”, “LIMITED”, “ltd”, “LTD”, “l.t.d” or “L.T.D”. Other provisions on naming conventions apply too. The application for name reservation and incorporation contains validation rules, prompting the applicant not to use restricted words and expressions. The proposed name is subject to the ultimate approval of the Registrar, which can be communicated to the applicant during application process via online registry solution.

Can I use an existing company name when I establish in ADGM?

To do so, you would need to show ownership of the proposed name, ie for example through any current licence that lists the shareholders. The proposed name must be in compliance with ADGM Companies Regulations and Business and Company Names Rules 2016, ie one of the prescribed suffixes to denominate the legal entity type private company limited by shares must be included. However, ADGM cannot grant a formal name approval until the application for name reservation or application for incorporation of a legal entity is lodged on the Online Registry Solution.

Are there any ongoing obligations for the company?

Yes. In addition to renewing the company's commercial licence annually, the company must meet other annual obligations with ADGM including:

- Maintain physical office address in ADGM at all times.

- Data Protection Renewal: ADGM Data Protection is required to be renewed annually before expiry. The cost of Data Protection renewal is USD 300.

- Annual Return Filing: Confirming the company’s details are up to date, accurate and complete (not to be confused with the entity's annual account filing).

- Annual Accounts Filing: Includes financial statements disclosure, the level of disclosure and requirements for audit depends on the company's revenue. Accounts must be filed annually regardless of the level of activity of a company.

- Please note that that the company has an obligation to notify the Registration Authority within the specified timeframe (as stated in ADGM Companies Regulations 2015) of any changes to the company’s information, including but not limited to, change of name, amendment of articles, change of address, appointment/cessation/change in details of directors and officers and changes to company’s share capital, shareholders and beneficial owners.

For more information, please refer to Guidance on Event Driven Filings.

Where and how do I apply for a Tech Startup Licence?

- Application is via the ADGM Online Registry Solution which is accessible 24/7. In addition to this, company service providers established in ADGM can guide you through the application process, including the business plan requirements and preparing the incorporation documentation on your behalf. View ADGM business directory.

Are there any additional costs?

Yes. Additional costs include office space, establishment card and visa costs, as well as the cost of the annual obligations mentioned above.

Does my licence permit me to open a bank account and commence invoicing activities?

Once your licence is issued by ADGM, you can apply for a bank account and commence invoicing activities, once your account is active. ADGM can provide you with a list of banks that are familiar with ADGM registration processes. The bank account opening remains subject to the bank’s policies and requirements.

After I submit the online application, how much time does it take for the approval process?

This depends on a number of factors including the quality of the application, the completeness of information provided in the required documentation, the initial approvals from the immigration authorities as well as the applicant’s responsiveness to additional queries if any. On average, and with the provision of complete documentation, applicants can expect a processing time of five working days.

Does ADGM's Tech Startup Licence allow us to sell our products across Abu Dhabi?

There is a dual-licence agreement in place between ADGM and Abu Dhabi Department of Economic Development (DED) that allows certain categories of tech startups that are established in ADGM to apply for, and receive, a DED licence without requiring an additional office space. However, ADGM will need to review your business plan and the type of activities before guiding you on whether they fit within the Tech Startup Licence criteria and are eligible for a DED licence application.

Startups looking to sell products need to seek legal advice to establish whether their activities require other Abu Dhabi or wider UAE approval or regulatory approvals.

Can I conduct financial related activities with a Tech Startup Licence?

Conducting regulated financial services in ADGM is not possible with a Tech Startup Licence. However, there are financial services related activities (such as software as a service), that are not regulated and which may be eligible for the Tech Startup Licence. Please contact ADGM to discuss further if you require more information.

How do I join Hub71, the tech ecosystem and community based in ADGM?

- Startups can apply for the Hub71 Incentive Programme before or after applying for the ADGM Tech Startup License via www.hub71.com.

- ADGM registered businesses can also apply to work within the Hub71 community by emailing the WeWork x Hub71 community via Alex Payani at alex.payani@wework.com.

I’m a FinTech, should I apply through RegLab? Or apply for the ADGM Tech Startup License first?

- RegLab is an ADGM program for Fintech startups. All startups need to apply for a license before they can operate within ADGM.

- You can apply for RegLab upon successful application to ADGM. Here is more information for Fintech companies.